As the world continues to shift towards sustainable energy sources, the clean energy sector has emerged as a lucrative investment opportunity. With global initiatives to reduce carbon emissions and combat climate change, clean energy companies are at the forefront of this green revolution. For investors looking to capitalize on this trend, Exchange-Traded Funds (ETFs) focused on clean energy provide a diversified and relatively low-risk entry point into the market.

Clean energy ETFs bundle together a variety of stocks from companies involved in renewable energy, energy efficiency, and other environmentally friendly technologies. These funds offer a balanced exposure to the sector, reducing the risk associated with investing in individual stocks. Here are seven clean energy ETFs that investors might consider adding to their portfolios.

1. iShares Global Clean Energy ETF (ICLN)

The iShares Global Clean Energy ETF is one of the most well-known ETFs in the clean energy space. It tracks the performance of the S&P Global Clean Energy Index, which includes 30 of the largest clean energy companies globally. The fund’s diverse holdings encompass solar, wind, and other renewable energy firms, making it a comprehensive investment in the sector.

2. Invesco Solar ETF (TAN)

For those specifically interested in solar energy, the Invesco Solar ETF is a prime choice. This ETF tracks the MAC Global Solar Energy Index, which includes companies that produce solar power equipment and components. Given the rapid growth of the solar industry, this ETF offers significant potential for capital appreciation.

3. First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

The First Trust NASDAQ Clean Edge Green Energy Index Fund focuses on companies involved in clean energy and other environmentally friendly technologies. This includes firms in the solar, wind, and biofuel sectors, as well as those working on energy storage and smart grid technologies. The ETF is designed to track the performance of the NASDAQ Clean Edge Green Energy Index.

4. SPDR S&P Kensho Clean Power ETF (CNRG)

The SPDR S&P Kensho Clean Power ETF is another option for investors seeking broad exposure to the clean energy sector. This ETF tracks the S&P Kensho Clean Power Index, which includes companies involved in the generation and distribution of renewable energy. The fund’s holdings are diversified across various clean energy sources, including solar, wind, and hydroelectric power.

5. ALPS Clean Energy ETF (ACES)

The ALPS Clean Energy ETF provides exposure to companies in North America that are leaders in clean energy production and technology. This ETF tracks the CIBC Atlas Clean Energy Index and includes a mix of large-cap and mid-cap stocks, offering a balance between growth potential and stability.

6. Invesco WilderHill Clean Energy ETF (PBW)

The Invesco WilderHill Clean Energy ETF tracks the WilderHill Clean Energy Index, which includes companies that are actively developing clean energy and conservation technologies. The ETF’s diverse portfolio spans multiple clean energy sectors, providing a well-rounded investment in the green energy space.

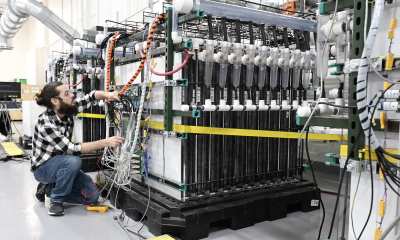

7. Global X Lithium & Battery Tech ETF (LIT)

While not exclusively focused on renewable energy, the Global X Lithium & Battery Tech ETF is a crucial component of the clean energy ecosystem. This ETF invests in companies involved in the mining and refining of lithium, as well as the production of batteries for electric vehicles and energy storage systems. As the demand for electric vehicles and renewable energy storage grows, this ETF offers substantial growth potential.

The Growing Importance of Clean Energy Investments

The transition to renewable energy sources is not just a trend but a necessity driven by environmental, economic, and regulatory factors. Governments worldwide are implementing policies to support the development of clean energy infrastructure. For instance, the European Union has set ambitious targets to achieve climate neutrality by 2050, which includes significant investments in renewable energy projects (European Commission). Similarly, the United States has rejoined the Paris Agreement, committing to substantial reductions in greenhouse gas emissions and supporting the growth of the clean energy sector (United Nations Climate Change).

These policies create a favorable environment for clean energy companies to thrive. As a result, ETFs that focus on this sector are likely to see increased investor interest and capital inflows. Additionally, advancements in technology are reducing the costs of renewable energy production, making it more competitive with traditional fossil fuels. This cost parity is expected to accelerate the adoption of clean energy solutions across various industries.

Benefits of Investing in Clean Energy ETFs

Investing in clean energy ETFs offers several advantages. Firstly, ETFs provide diversified exposure to the sector, reducing the risk associated with investing in individual stocks. This diversification is particularly important in the clean energy sector, where companies can be affected by factors such as government policy changes, technological advancements, and market dynamics.

Secondly, clean energy ETFs are managed by professional fund managers who actively monitor market trends and make adjustments to the fund’s holdings as necessary. This active management helps ensure that the ETF remains aligned with its investment objectives and can adapt to changing market conditions.

Moreover, clean energy ETFs are a liquid investment vehicle, meaning they can be easily bought and sold on stock exchanges. This liquidity provides investors with flexibility and the ability to quickly respond to market movements.

Considerations for Investors

While clean energy ETFs offer promising opportunities, investors should be mindful of certain considerations. The clean energy sector can be volatile, with stock prices influenced by factors such as changes in government policies, technological breakthroughs, and fluctuations in energy prices. As with any investment, it is important to conduct thorough research and consider one’s risk tolerance and investment goals.

Investors should also pay attention to the expense ratios of ETFs, which can affect overall returns. Expense ratios represent the annual fees charged by the fund to cover management and operational costs. Generally, lower expense ratios are more favorable for investors.

Finally, it is important to stay informed about developments in the clean energy sector and regularly review one’s investment portfolio. Keeping up with industry news, regulatory changes, and technological advancements can help investors make informed decisions and capitalize on emerging opportunities.

Conclusion

The clean energy sector presents a compelling investment opportunity for those looking to align their portfolios with the global shift towards sustainability. Clean energy ETFs offer a diversified and relatively low-risk way to invest in this growing market. By choosing ETFs that align with their investment objectives and risk tolerance, investors can participate in the green energy revolution while potentially reaping significant financial rewards.

As the world continues to prioritize clean energy, the demand for renewable energy sources and technologies is expected to rise. This growing demand, coupled with supportive government policies and technological advancements, positions clean energy ETFs as a smart investment choice for the future. For investors ready to embrace the green energy wave, now is the time to explore the promising world of clean energy ETFs.

For more detailed information on specific clean energy ETFs, refer to the original article from U.S. News.

Home4 years ago

Home4 years ago

Medical4 years ago

Medical4 years ago

Gadgets4 years ago

Gadgets4 years ago

Environment4 years ago

Environment4 years ago

Medical4 years ago

Medical4 years ago

Energy4 years ago

Energy4 years ago