In a groundbreaking move set to redefine the landscape of industrial automation, Vention has announced a strategic partnership with NVIDIA, leveraging advanced artificial intelligence (AI) technologies to democratize the sector. This collaboration, centered on Vention’s cloud-based Manufacturing Automation Platform (MAP), aims to bring sophisticated automation solutions to a broader range of businesses, thereby enhancing efficiency and productivity across industries.

The Dawn of Accessible Automation

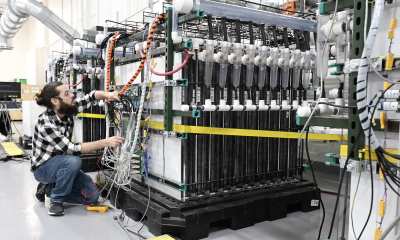

Vention’s mission to make industrial automation more accessible is not new. The company has been a pioneer in offering customizable and scalable automation solutions that cater to the unique needs of small and medium-sized enterprises (SMEs). By integrating NVIDIA’s AI technologies into its platform, Vention is poised to take this mission to new heights. The integration will empower users with advanced capabilities such as predictive maintenance, real-time data analytics, and enhanced machine learning, making sophisticated automation tools available to businesses that previously lacked the resources to implement such technologies.

Harnessing the Power of AI

The core of this initiative lies in the integration of NVIDIA’s AI technologies, renowned for their robustness and versatility. NVIDIA’s AI platform is designed to handle vast amounts of data and perform complex computations rapidly, making it an ideal fit for industrial applications. By embedding these capabilities into Vention’s MAP, businesses can now harness the power of AI to optimize their operations. For instance, predictive maintenance powered by AI can foresee potential equipment failures before they occur, significantly reducing downtime and maintenance costs. Similarly, real-time data analytics can provide actionable insights, enabling businesses to make informed decisions swiftly.

Empowering the Manufacturing Sector

The collaboration is set to benefit a wide array of industries, particularly manufacturing, which stands to gain immensely from advanced automation solutions. The manufacturing sector has long been a cornerstone of economic growth, but it has also faced challenges such as high operational costs and inefficiencies. With the introduction of AI-driven automation, manufacturers can streamline their processes, improve product quality, and reduce operational costs. This transformation is crucial for maintaining competitiveness in a global market that is increasingly driven by technology and innovation.

AI and the Future of Work

One of the significant implications of this partnership is its potential impact on the workforce. As automation becomes more prevalent, there is a growing concern about the displacement of jobs. However, Vention and NVIDIA’s approach is centered on augmenting human capabilities rather than replacing them. By automating repetitive and mundane tasks, workers can focus on more complex and creative aspects of their jobs. Additionally, the need for skilled workers to manage and maintain these advanced systems will create new employment opportunities, fostering a more skilled and knowledgeable workforce.

Collaboration with Industry Leaders

The announcement has garnered attention from industry leaders and experts who recognize the transformative potential of this partnership. According to IndustryWeek, integrating AI into industrial automation represents a significant leap forward in the evolution of manufacturing technologies. Furthermore, the International Federation of Robotics emphasizes the role of AI in enhancing the capabilities of robotic systems, which are integral to modern manufacturing processes.

Sustainability and Efficiency

Another critical aspect of this collaboration is its contribution to sustainability. As businesses strive to reduce their carbon footprint and adopt more environmentally friendly practices, AI-driven automation offers viable solutions. Efficient resource management, reduced waste, and optimized energy consumption are some of the ways through which AI can help businesses achieve their sustainability goals. This alignment with environmental objectives not only benefits the planet but also enhances the reputation and compliance of businesses in an increasingly eco-conscious market.

Case Studies and Real-World Applications

To illustrate the practical benefits of this collaboration, consider the case of a mid-sized manufacturing company that implemented Vention’s AI-enhanced MAP. By utilizing predictive maintenance, the company was able to reduce its downtime by 30%, resulting in significant cost savings and improved productivity. Additionally, real-time data analytics provided insights into production bottlenecks, allowing the company to streamline its processes and increase output. These tangible benefits highlight the potential of AI-driven automation to revolutionize industrial operations.

The Road Ahead

As Vention and NVIDIA continue to innovate and expand their collaboration, the future of industrial automation looks promising. The integration of AI into manufacturing processes is just the beginning. Future developments may include more sophisticated machine learning algorithms, greater interoperability between different automation systems, and further enhancements in data analytics capabilities. These advancements will continue to drive efficiency, productivity, and competitiveness in the industrial sector.

Conclusion

The partnership between Vention and NVIDIA marks a significant milestone in the journey towards democratizing industrial automation. By making advanced AI technologies accessible to a broader range of businesses, this collaboration has the potential to transform industries, enhance efficiency, and promote sustainability. As businesses embrace these innovations, they will be better equipped to navigate the challenges of the modern industrial landscape and thrive in an increasingly competitive market.

For more detailed insights into this collaboration, visit the official press release.

Home4 years ago

Home4 years ago

Medical4 years ago

Medical4 years ago

Gadgets4 years ago

Gadgets4 years ago

Environment4 years ago

Environment4 years ago

Medical4 years ago

Medical4 years ago

Energy4 years ago

Energy4 years ago